CMS Releases Its Hospital Inpatient Prospective Payment System Proposed Rule For FY 2022

On May 10, 2021, the Centers for Medicare and Medicaid Services (“CMS”) published a proposed rule updating Medicare policies under the acute-care hospital inpatient prospective payment system (“IPPS”) for fiscal year (“FY”) 2022. This article summarizes certain key changes to the IPPS proposed by CMS for FY 2022. For additional information on all proposed changes to Medicare policies, please refer to the Federal Register. The corresponding tables and data files for the FY 2022 IPPS proposed rule are available on the FY 2022 Proposed Rule Home Page. Comments are due by 5:00 pm EST on June 28, 2021.

IPPS UPDATES

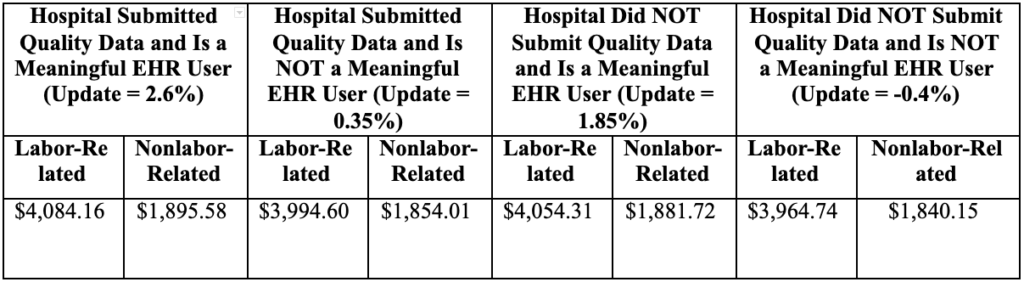

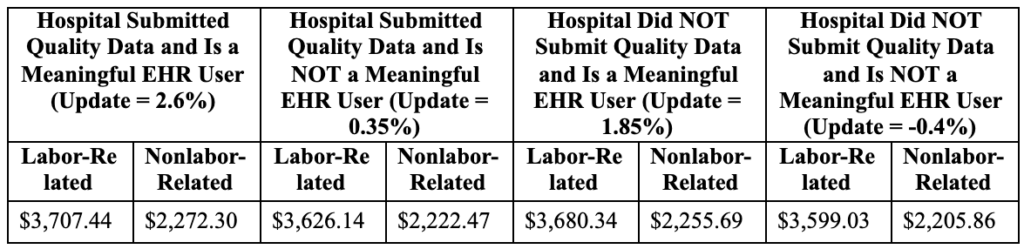

The proposed IPPS increase in operating payment and capital rates for acute care hospitals that successfully participate in the Hospital Inpatient Quality Reporting (“IQR”) Program and are meaningful electronic health record (“EHR”) users is approximately 2.8%. The tables below show the proposed updates to the standardized amounts for FY 2022.

Table 1A. – Proposed Rule National Adjusted Operating Standardized Amounts; Labor/Nonlabor (67.6% Labor Share/32.4% Nonlabor Share If Wage Index Is Greater Than One)

Table 1B. – Proposed Rule National Adjusted Operating Standardized Amounts, Labor/Nonlabor (62% Labor Share/38% Nonlabor Share If Wage Index Is Less Than or Equal to One)

CMS is also proposing to establish an update of 0.70% in determining the capital Federal rate for all hospitals for FY 2022. Accordingly, for FY 2022, CMS proposes to establish a national capital Federal rate of $471.89.

OUTLIER THRESHOLD

The outlier threshold for FY 2021 was $29,064. CMS is proposing an increase to $30,967. CMS is basing the threshold on cost report data from dates before the COVID-19 public health emergency (“PHE”).

CHARGE DATA FOR MEDICARE-SEVERITY DIAGNOSIS RELATED GROUPS (“MS-DRGS”)

Historically, MS-DRG weights have been calculated based on hospital cost to charge ratios (“CCR”) reported on the Medicare cost report, and the gross charge data for the CCR is obtained from a hospital’s chargemaster. CMS had finalized a rule to transition to calculating MS-DRG weights based on the negotiated charges from Medicare Advantage Organizations and to collect the data based on Medicare cost reports for cost-reporting periods ending on or after January 1, 2021. CMS is proposing to repeal this change.

DISPROPORTIONATE SHARE HOSPITAL (“DSH”) AND UNCOMPENSATED CARE POOL PAYMENTS

Since FY 2014, eligible hospitals have received DSH payments equal to 25% of traditional DSH payments as calculated at 42 U.S.C. § 1395ww(d)(5)(F). CMS refers to this 25% payment as the “empirically justified DSH payment.” In addition, eligible hospitals receive a payment that is based on an “uncompensated care pool.” Specifically, the additional DSH payment is calculated using three factors: 1) 75% of the payments that would have been made to all hospitals under 42 U.S.C. § 1395ww(d)(5)(F); 2) the percentage change in the uninsured population since 2013; and 3) the ratio of each hospital’s uncompensated care to uncompensated care for all DSH hospitals. A hospital’s payment from the uncompensated care pool is the product of these three factors.

CMS proposes to continue its prior policy for Factor 1 in FY 2022. CMS, thus, proposes that the Factor 1 amount will be $10,573,368,841.28, which is equal to 75% of the total amount of Medicare DSH payments for FY 2022 ($14,097,825,121.71 minus $3,524,456,280.43).

Factor 2 is an adjustment equal to one minus the percentage change in the national rate of uninsurance for the current year, as compared to a base of 2013. For FY 2018 through FY 2021, CMS used uninsured estimates produced by the Office of the Actuary as part of the development of the National Health Expenditure Accounts (“NHEA”), which reflect the rate of uninsurance in the U.S. across all age groups. In addition, CMS calculates the current-year rate of uninsurance based on a weighted average of the uninsurance estimate for the current and prior calendar years (“CY”).

CMS proposes to continue this methodology in FY 2022. CMS estimates that the uninsurance rate for CYs 2021 and 2022 will be 10.2% and 10.1%, respectively, compared to the 2013 base rate of 14%. CMS estimates the percent of individuals without insurance for FY 2022 will be 10.1% ((0.25 times 0.0102) + (0.75 times 0.0101)). Therefore, CMS is proposing that Factor 2 for FY 2022 will be 72.14% (1- [((0.101-0.14)/0.14)] = 1-0.2786 = 0.7214 (72.14%)). This results in a proposed total uncompensated care pool of $7,627,628,282.10 (i.e., $10,573,368,841.28 times 0.7214).

Factor 3 is each eligible DSH hospital’s estimated uncompensated care amount relative to the estimated uncompensated care amount for all eligible DSH hospitals. CMS proposes to calculate Factor 3 for each hospital for FY 2022 using the following steps:

- Step 1: Select the hospital’s longest cost report from its Federal fiscal year (“FFY”) 2018 cost reports. (If the hospital does not have an FFY 2018 cost report because the cost report for the previous FFY spanned the FFY 2018 time period, the previous FFY cost report would be used in this step.)

- Step 2: If the cost report is more than or less than 12 months, annualize the uncompensated care costs from Worksheet S-10 Line 30. (If applicable, use the statewide average CCR (urban or rural) to calculate uncompensated care costs.)

- Step 3: Combine the adjusted and/or annualized uncompensated care costs for hospitals that merged using the merger policy.

- Step 4: Calculate Factor 3 for Indian Health Service and Tribal hospitals based on Medicaid days for FY 2013 and the most recent available year of data on Supplemental Security Income (“SSI”) days. Calculate Factor 3 for Puerto Rico hospitals that have a FY 2013 cost report based on Medicaid days for FY 2013 and 14% of the hospital’s FY 2013 Medicaid days. Calculate the denominator using the low-income insured days proxy data from all DSH eligible hospitals.

- Step 5: Calculate Factor 3 for the remaining DSH eligible hospitals using annualized uncompensated care costs (Worksheet S-10 Line 30) based on FY 2018 cost report data from Step 1, 2, or 3. This calculation excludes new hospitals and the hospitals for which Factor 3 was calculated in Step 4.

Similar to previous years, in general, CMS performed the proposed Factor 3 calculation using HCRIS data updated through February 19, 2021. CMS intends to use the March 2021 update to HCRIS to calculate Factor 3 in the final rule, and CMS intends to use the March updates to calculate Factor 3 in all future final rules. For new hospitals that do not have an FY 2018 cost report to use in the Factor 3 calculation, CMS proposes to continue to apply the new hospital policy that it initially adopted in the FY 2020 IPPS final rule. The proposed rule also sets forth proposals regarding newly merged hospitals, the CCR trim methodology, and the uncompensated care data trim methodology.

Since FY 2014, CMS has made interim uncompensated care payments during the fiscal year on a per discharge basis, using a 3-year average of the number of discharges for a hospital to produce an estimate of the amount of the hospital’s uncompensated care payment per discharge. For FY 2022, CMS proposes to modify this calculation to be based on the average of FY 2018 and FY 2019 historical discharge data, as opposed to a 3-year average.

CMS published on its website a table listing Factor 3 for certain hospitals for FY 2022 and a supplemental data file with a list of the hospital mergers that CMS is aware of and the uncompensated care payments for each merged hospital. Hospitals should notify CMS within 60 days from the date of public display of the proposed rule of any inaccuracies. The proposed rule also notes that after publication of the FY 2022 IPPS final rule, hospitals will have 15 business days to again review and submit comments on the accuracy of the table and supplemental data file. Changes to Factor 3 would be posted on the CMS website and would be effective beginning October 1, 2021.

MEDICARE BAD DEBTS

Medicaid programs often have policies that limit their responsibility to pay cost-sharing amounts for Medicare/Medicaid dual eligible individuals if the Medicaid payment for the service is less than the Medicare payment. In these situations, a hospital may claim any cost-sharing amount as a Medicare bad debt if the hospital bills the Medicaid program and receives a remittance advice stating that the Medicaid program will not pay (or will pay a lesser amount than the hospital plans to claim as bad debt). This policy is referred to as the bad debt “must bill” policy.

CMS states that certain types of providers have been unable to submit claims to Medicaid programs in accordance with the “must bill” policy because the Medicaid program does not recognize that category of provider under its Medicaid State Plan and, therefore, refuses enrollment. In the proposed rule, CMS proposes that, for purposes of determining Medicare cost sharing obligations only, State Medicaid programs must accept enrollment of all Medicare-enrolled providers if the provider otherwise meets all Federal Medicaid enrollment requirements and even if a provider is of a type not recognized as eligible to enroll in the State Medicaid program. CMS proposes that State Medicaid programs comply with this proposal in time to process cost-sharing claims for dually eligible beneficiaries with dates of service beginning January 1, 2023.

CMS also considered a rule that would require Medicaid agencies to process claims for Medicare cost-sharing without requiring that the claim meet the Medicaid State plan coverage and payment rules for that service. CMS requests feedback from stakeholders on this issue and will consider whether to include such a policy in future rulemaking.

WAGE INDEX AND RECLASSIFICATION

CMS is proposing to continue its “low wage index hospital policy,” under which it increases the wage index for hospitals with a wage index value below the 25th percentile wage index value for a fiscal year by half the difference between the otherwise applicable final wage index value for a year for that hospital and the 25th percentile wage index value for that year across all hospitals.

CMS is proposing to continue its imputed rural floor policy, under which it imputes a rural floor for states that only consist of urban areas. CMS also proposes to include Washington, DC as a “state” for purposes of the imputed rural floor. As noted above, for hospitals with a wage index greater than one, CMS proposes to decrease the labor-related share of the standardized amount from 68.3 to 67.6. The proposed rule wage index tables 2, 3, and 4 can be found on the FY 2022 Proposed Rule Home Page.